“Measure what matters. Improve what counts.”

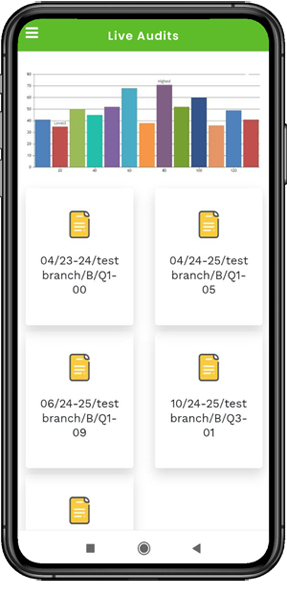

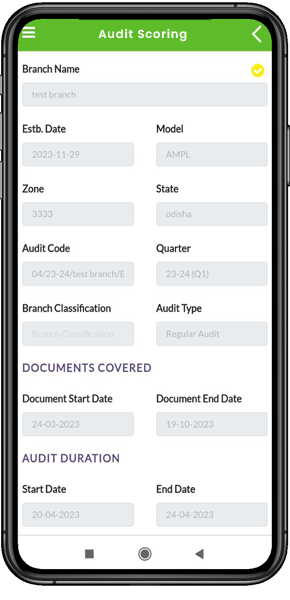

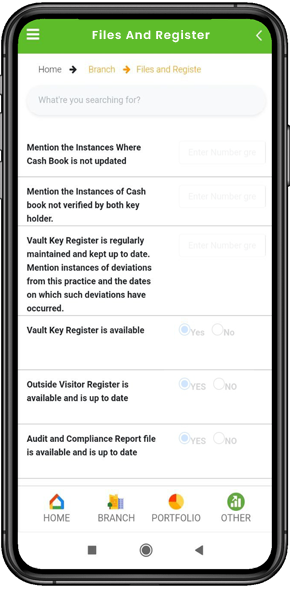

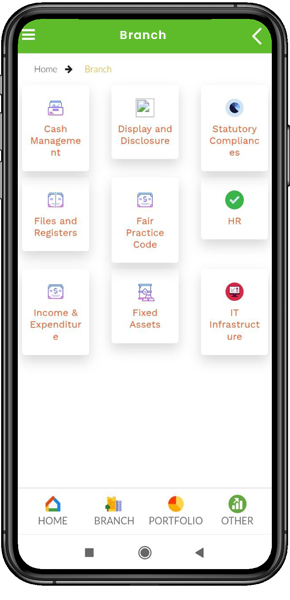

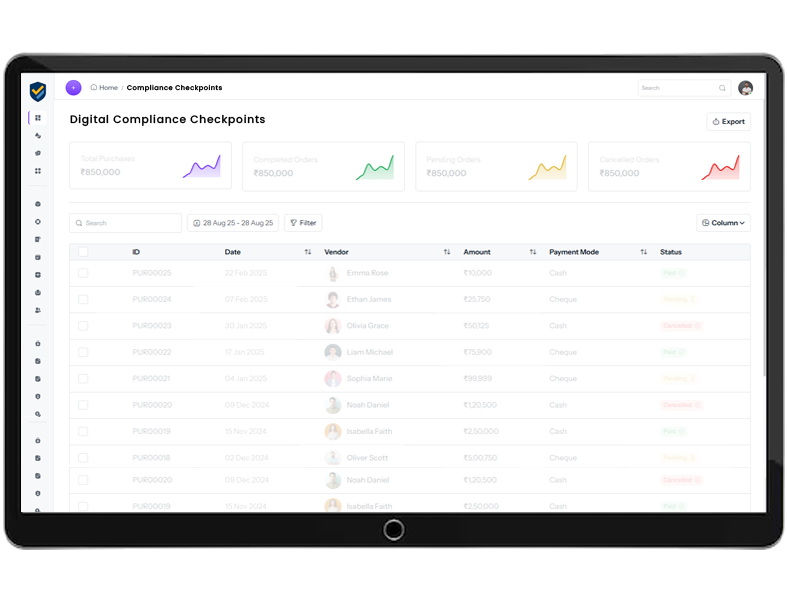

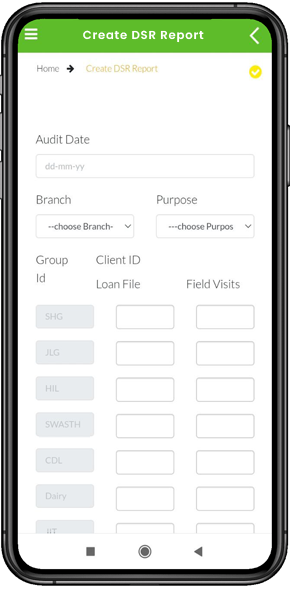

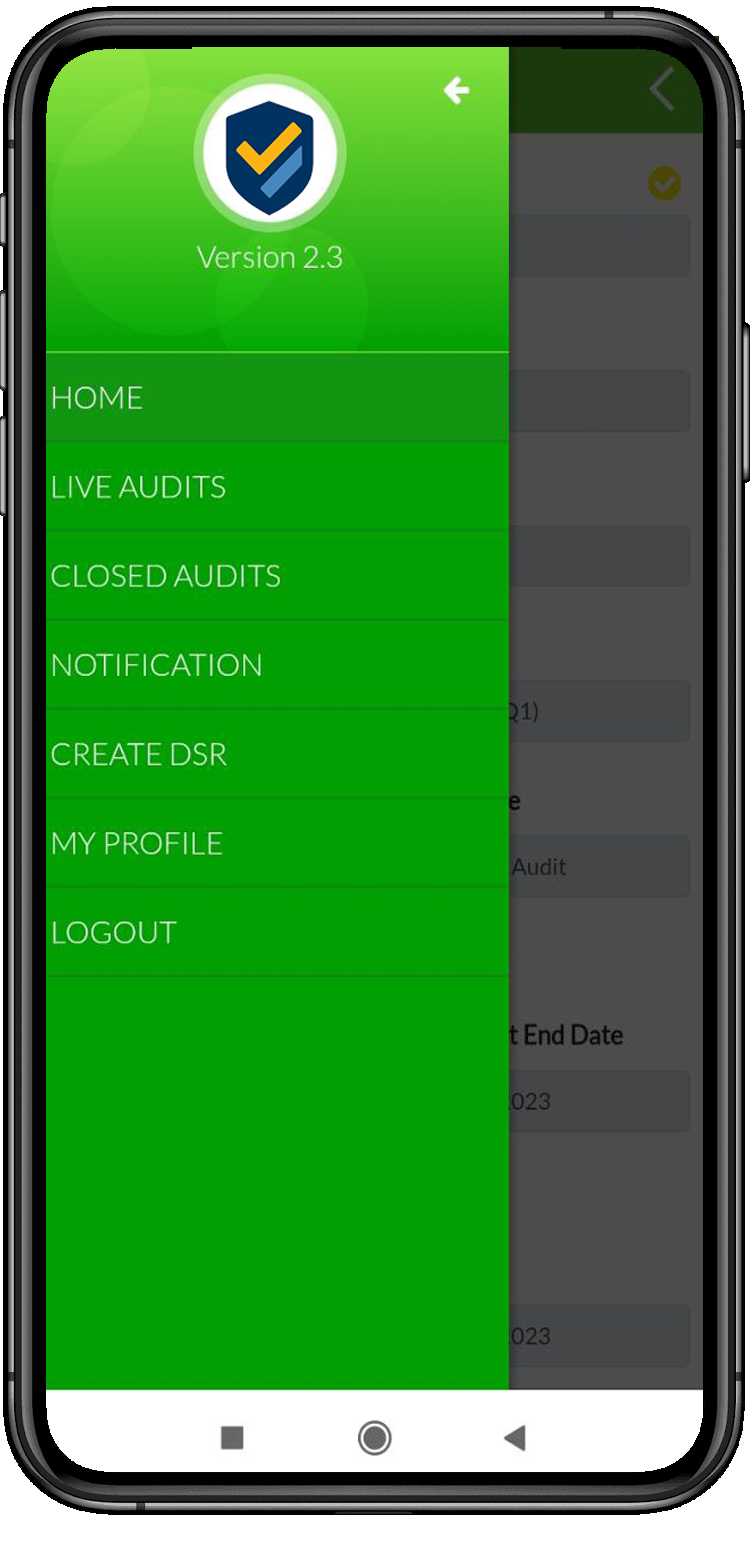

Komply’s intelligent Audit Scoring turns compliance into measurable results. Every loan, deposit, or withdrawal is automatically verified, with instant scores that reflect branch performance, accuracy, and compliance.

Unlike manual audits, Komply delivers fair, real-time results—flagging errors, missing documents, and compliance gaps instantly, while rewarding strong practices. This gives management reliable benchmarks and branch managers clear visibility.

Powered by AI, Audit Scoring not only evaluates today’s compliance but also predicts future risks. Intuitive dashboards make reporting simple, with branch-wise comparisons and real-time insights that drive confident decision-making.

With Komply, Audit Scoring becomes more than compliance—it’s a driver of accountability, efficiency, and growth.